Project Title & Summary

Project Title & Summary

Title: Credit Risk Analysis — Predicting Loan Defaults with Machine Learning

A machine learning project designed to identify borrowers at high risk of default using demographic and financial data. This solution enables smarter, risk-aware lending decisions through predictive modeling and Power BI dashboards for business insight.

Files

Files

Project Objectives

Project Objectives

To build a classification model that can predict whether a borrower will default, and to create a business-friendly dashboard that highlights high-risk customer segments.

Data Overview

Data Overview

- Source: Kaggle loan default dataset.

- Size: 32,581 rows, 12 columns.

- Features: person_age, person_income, person_home_ownership, person_emp_length, loan_intent, loan_grade, loan_amnt, loan_int_rate, loan_status, loan_percent_income, cb_person_default_on_file, cb_preson_cred_hist_length.

- Key columns: Include person_age, person_income, loan_amnt, loan_int_rate, loan_intent, and the target: loan_status.

Data Cleaning & Exploration

Data Cleaning & Exploration

- Detected and capped outliers in age and emp_length

- Filled missing emp_length with median

- Used regression to impute missing loan_int_rate

- Detected and dropped duplicates

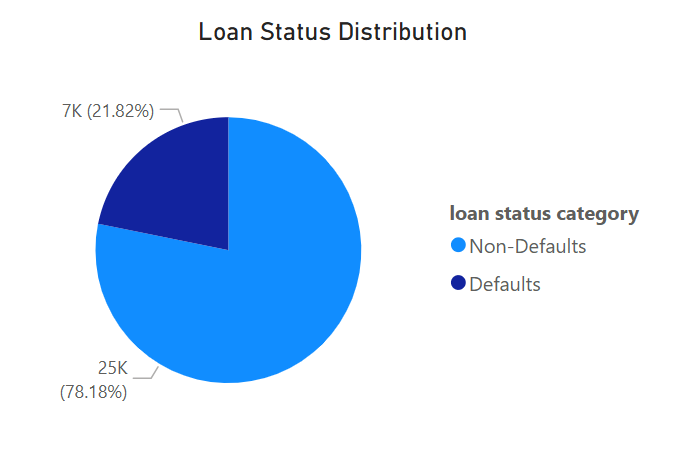

- Class imbalance observed in loan_status (many more paid than defaults)

Feature Engineering

Feature Engineering

- One-hot encoding on categorical variables (e.g., loan_intent, education).

- Feature selection using LightGBM feature importance.

- Created dummy variables to support tree-based models.

Feature Relationships.

- Used Sklearn - Mutual information feature.

- No strong linear relationship between target and other features.

- person_income: (score = 0.114) Most informative! Income plays a big role in predicting default. The higher the income, the lower the chance of default.

- loan_int_rate: (score = 0.084) High interest rates correlate with increased risk. Possibly reflects lenders charging more to risky individuals.

- loan_percent_income: (score = 0.080) Borrowing a high % of one’s income = higher risk.

Target Distribution

Class imbalance detected

Modeling

Modeling

- Model Used: LightGBM Classifier

- Why LightGBM? Handles imbalance, fast training, interpretable

- Techniques Applied

- class_weight='balanced'

- Cross-validation (5-fold)

- Precision-recall threshold tuning to favor recall over precision

Goal: Minimize financial risk by catching as many defaulters as possible, even if some paying customers are flagged.

Results

Results

| Metric | Accuracy | AUC-ROC |

|---|---|---|

| Train Set | 93.50% | 97.42% |

| Test Set | 89.14% | 94.54% |

- Good generalization — minor overfit, acceptable

- Threshold tuning improved recall with controlled precision

Business Insights Dashboard

Business Insights Dashboard

Built in Power BI for the marketing team

Key Metrics

- Total Customers

- Dominant Age Group

- Most Common Loan Intent

- Average Income

- Overall Default Rate

- Average Loan Percent Income

Behavior & Affordability Visuals.

- Age Group vs Loan Percent Income (Mean): Highlights which age groups are taking loans that are a larger share of their income.

- Loan Amount by Age Group: Shows how much each group borrows. While not directly about risk, it gives insight into demand — useful for sizing up campaign efforts.

- Avg Loan Percent Income by Loan Status: Illustrates how the repayment burden (as a % of income) correlates with defaults — useful for messaging or prequalification criteria.

- Amount by Loan Intent: Reflects which loan purposes require higher funding. Again, helps guide the focus of targeted campaigns (e.g. more budget toward high-intent categories).

- Default Rate by Income Bracket: Tells us how income levels relate to default risk. If lower income = higher default, marketing might want to focus on more financially secure brackets — like how luxury brands target exclusive audiences.

Key Learnings

Key Learnings

- Handling real-world data messiness (missing values, outliers, imbalance)

- Precision vs Recall trade-off in business contexts

- End-to-end ML pipeline, from data cleaning to dashboard delivery

Conclusion

Conclusion

- This project demonstrates the integration of machine learning and business intelligence to not only predict risk but inform business.

- The model performs well, the dashboard tells a story, and both are tools to empower decision-makers.